Historic Tax Credits

Pictured above: Central Station Hotel by Bounds & Gillespie | LRK, a Federal Historic Tax Credit project and 2020 Design Merit Award winner

Tennessee Historic Development Grant Pilot Program

In April 2021 the Tennessee General Assembly developed the Historic Development Grant Program (HDGP) and allocated $4.8 million to renovate and preserve the State’s historic buildings. The legislators recognized that historic buildings and their preservation expand the state’s economy, create new employment opportunities, revitalize and renew communities, create an environment for investment, and promote tourism and rural economic development. Representative Kevin Vaughan (District 95, Collierville) and Senator Jon Lundberg (District 4, Bristol) led the effort.

> Learn about the Tennessee Historic Grant Program

> Read AIA Memphis press release

Tax Incentives for Preserving Historic Properties

The Federal Historic Preservation Tax Incentives program encourages private sector investment in the rehabilitation and re-use of historic buildings. It creates jobs and is one of the nation's most successful and cost-effective community revitalization programs. It has leveraged over $102.64 billion in private investment to preserve 45,383 historic properties since 1976. The National Park Service and the Internal Revenue Service administer the program in partnership with State Historic Preservation Offices.

20% Tax Credit

A 20% income tax credit is available for the rehabilitation of historic, income-producing buildings that are determined by the Secretary of the Interior, through the National Park Service, to be “certified historic structures.” The State Historic Preservation Offices and the National Park Service review the rehabilitation work to ensure that it complies with the Secretary’s Standards for Rehabilitation. The Internal Revenue Service defines qualified rehabilitation expenses on which the credit may be taken. Owner-occupied residential properties do not qualify for the federal rehabilitation tax credit. Learn more about this credit before you apply.

Each year, Technical Preservation Services approves approximately 1200 projects, leveraging nearly $6 billion annually in private investment in the rehabilitation of historic buildings across the country. Learn more about this credit in Historic Preservation Tax Incentives.

10% Tax Credit

PLEASE NOTE that Public Law No: 115-97 (December 22, 2017) repealed the 10% tax credit.

The 10% tax credit is available for the rehabilitation of non-historic buildings placed in service before 1936. The building must be rehabilitated for non-residential use. In order to qualify for the tax credit, the rehabilitation must meet three criteria: at least 50% of the existing external walls must remain in place as external walls, at least 75% of the existing external walls must remain in place as either external or internal walls, and at least 75% of the internal structural framework must remain in place. There is no formal review process for rehabilitations of non-historic buildings.

Tax Benefits for Historic Preservation Easements

A historic preservation easement is a voluntary legal agreement, typically in the form of a deed, that permanently protects an historic property. Through the easement, a property owner places restrictions on the development of or changes to the historic property, then transfers these restrictions to a preservation or conservation organization. A historic property owner who donates an easement may be eligible for tax benefits, such as a Federal income tax deduction. Easement rules are complex, so property owners interested in the potential tax benefits of an easement donation should consult with their accountant or tax attorney. Learn more about easements in Easements to Protect Historic Properties: A Useful Historic Preservation Tool with Potential Tax Benefits.

Annual Report on the Economic Impact of the Federal Historic Tax Credit for Fiscal Year 2019

Released October 2020, this report authored by Rutgers and the National Park Service outlines a detailed analysis of how the Federal Historic Tax Credit impacts jobs, income, wealth, output and taxes. It demonstrates $173.7 billion cumulative historic rehabilitation investments since the program's inception in 1978.

In Tennessee the report shows the following for FY2015-2019:

- $498.3 million Total Rehabilitation Costs

- 8,486 Jobs - most of which is in construction

- $349.4 million Income

- $483.3 million GDP - most of which is in construction

- $928.7 million Output

- $1,084.9 million Local taxes

- $823.5 million State taxes

- $6,267.4 million Federal taxes

- $8,175.8 million Total taxes

Federal Tax Incentives for Rehabilitating Historic Buildings

Annual Report for Fiscal Year 2019

Released March 2020 by the National Park Service, the report begins with the statement "A Successful Federal/State Partnership since 1976." The State of Tennessee is currently one of only 13 states without a state historic tax credit. AIA Memphis along with our statewide partners are working to advocate to change that.

Novogradac Historic Tax Credit

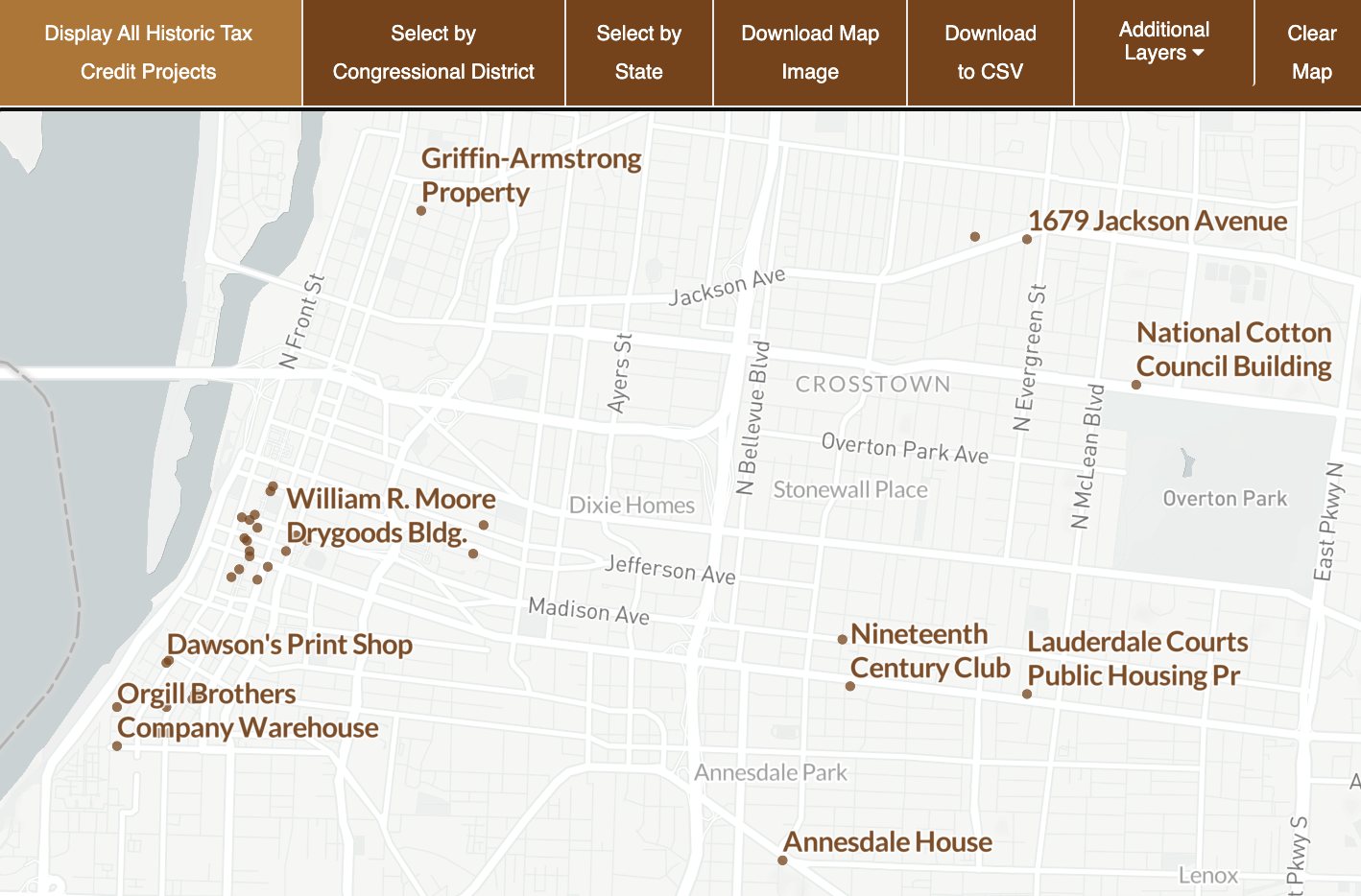

Resource Center & Mapping Tool

2017

For up-to-the-minute information on properties, visit Novogradac's Historic Tax Credit Resource Center (which also contains extensive resources for New Markets and Low Income Housing Tax Credits as well). Specifically, visit the site's Historic Tax Credit Mapping Tool to explore buildings in an interactive map interface.

Federal Historic Tax Credit Projects: Tennessee

2017

For a list of buildings in Tennessee that have utilized the Federal Historic Tax Credit, this 2017 report covering the period 2002-2016 is a great start. The graphic below is an overview of Memphis' use of the credits compared to other regions of the state.

AIA Memphis advocacy for a

Tennessee State Historic Tax Credit

Starting in the Fall of 2020, AIA Memphis began an education campaign to help architects, elected officials and property owners understand the power of combining the Federal Historic Tax Credit (20% tax credit) with a proposed Tennessee State Historic Tax Credit. Below is a list of efforts along with resources:

- AIA Tennessee Government Relations Committee - AIA Memphis has joined with our statewide partners in an effort to again introduce the policy in the 2021 Tennessee Legislative session. In early February 2021, SB0678 and HB 1354 were Introduced in the Tennessee General Assembly. > Follow their progress

- Memphis Heritage, Marine Hospital Insiders' Tour, October 29, 2020 - a 3-minute video was presented at the beginning of this virtual event to help viewers understand how the Federal Historic Tax Credit helped make the project possible.

- Memphis City Council presentation & resolution - On December 15, 2020, Amber Lombardo (AIA Memphis Executive Director) appeared at the request of Councilman Chase Carlisle and Memphis Heritage to talk about how the HTC can benefit projects of all sizes. The committee voted to pass a Resolution supporting the creation of a TN Historic Tax Credit.

- Third Thursday - The January 2021 Third Thursday programming for AIA Memphis will feature Chase Carlisle (City of Memphis Councilman) and Holly Fulkerson (Memphis Heritage) to present a selection of endangered historic buildings that could be saved if the state adopted a Historic Tax Credit. Guests will also receive an overview of how the credit works and its impact in other states.

To request a presentation on the topic by AIA Memphis Executive Director, Amber Lombardo, please email for more information. This service is free within the Memphis metro area. Outside the area is typically charged at customary travel expense.